Discretionary Portfolio Management

Our Discretionary Portfolio Management service enables investor to delegate the management of the investment portfolio to institutional-class investment professionals with a pre-determined return/risk parameters.

Our investment professionals cover all key asset classes including individual securities, bonds, funds and structural investments.

The investment team will actively manage the portfolio in response to the changing market environment to ensure your portfolio will be optimized at all times.

First, the team will determine the investment goal of the investor and tailor-made an investment solution depending on the preferred risk/return, investment horizon and liquidity preference. The next step is to select the most suitable securities in which your assets will be invested. Each investment idea will be examined on its business fundamentals, thematic undercurrents, valuations and financial analysis.

Performance review will be performed regularly with the investor to make sure the strategy is still appropriate to the investor.

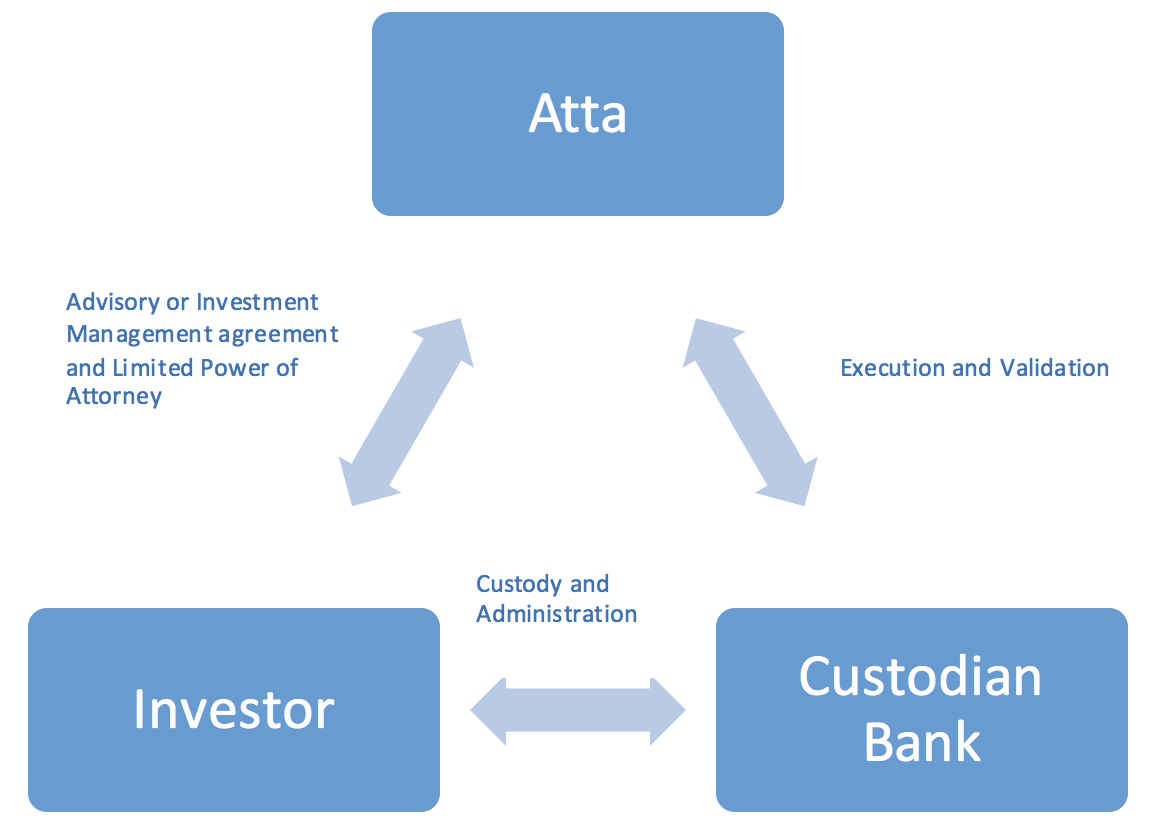

Our Business Model

We offered Investors an open architecture structure and investors has the right to choose the custodian bank where they like to custody their investment assets and accounts. We manage investment portfolio according to the mutually predetermined parameters at investor’s custodian bank based on the Limited Power of Attorney. The Limited Power of Attorney allows us to manage the assets more efficiently yet we don’t have power to transfer assets out of the account.